Governor JB Pritzker signed into law the Fiscal Year 2026 Budget for the State of Illinois. The budget passed by Democratic legislators and signed by Gov. Pritzker will spend $55.2 billion, which is nearly $2 billion more than the FY25 enacted budget. State spending has increased by more than $15 billion, a 38% increase, since Pritzker took office in 2019. Illinois residents deserve tax relief, not tax increases and I will continue to work hard to reduce the cost of living for Illinois citizens.

In-District

Earlier this week, I attended the St. Clair County police chief meeting to discuss recent legislation that passed in the General Assembly. Our law enforcement officers are the backbone to community safety, and I want to know exactly how laws have impacted their duties. The meeting was informative and we had productive conversations about improving public safety.

It was a pleasure to meet with Shaun Cobbs Sr, CEO of Cobbs Vizion Studios!

Mr. Cobbs is currently working to expand Cobbs Vizion Studios in East St. Louis to develop a state-of-the-art film, and digital media production campus paired with a surrounding promenade district that will serve as a cultural, economic, and recreational hub.

Beyond the screen, Shaun is committed to empowering communities and fostering artistic growth. He actively supports initiatives focused on education, the arts, and social impact, believing that storytelling has the power to inspire change and elevate voices that deserve to be heard.

375 Air Mobility Wing change of command at Scott Air Force Base. Colonel John D. Poole relinquished command to Colonel Matthew L Collins.

Business of the Month

Mascoutah, IL…After receiving submissions from across the 114th District, State Representative Kevin Schmidt (R-Millstadt) is happy to name St Clair Chiropractic his “Business of the Month” for June. Rep. Schmidt presented Dr. Rachel Engelke, Dr. Melissa Huber and their team with an official certificate of recognition for their superior patient treatment and other services they provide to Mascoutah and surrounding area residents.

“Dr. Rachel Engelke and Dr. Melissa Huber are doing great work providing exceptional wellness services to residents of Mascoutah and nearby communities,” said Schmidt. “The whole team at St. Clair & Elite Chiropractic is committed to improving the lives of people through treatment and education so they can live life to the fullest.”

St. Clair & Elite Chiropractic utilizes several individualized therapies and techniques to make the road to pain relief, recovery, and total-body-wellness efficient, effective and worthwhile. Their experienced doctors are focused on improving the quality of life for people and making sure they leave the clinic feeling better than when they walked in.

Rep. Kevin Schmidt encourages the 114th District to nominate businesses to be recognized in the future. If you have a business you’d like to nominate, visit the Resources tab at RepSchmidt.com. and submit the form.

Save the Date!

State Representative Kevin Schmidt is hosting a Shred Event and Canned Food Drive on Saturday, July 12 from 9:00 AM to 11:00 AM at the Village Park in Millstadt!

This is a drive-up event for free shredding of your confidential documents. Legislative staff will be on hand to answer questions about state programs or discuss issues.

“If you have old medical records, financial statements, or other sensitive information you’re looking to safely dispose of – now’s your chance!” said Schmidt.

More Taxes

On Pritzker’s watch, over $3 billion has been spent on services for migrants and illegal immigrants, while services for our most vulnerable citizens remain chronically underfunded and underserved. Our fiscal condition will always be on unsteady ground if we continue to rely on future revenues and tax hikes. We also cannot rely on federal dollars to dig us out of our own mess.

On the revenue side, the budget features more than $800 million in revenue gimmicks featuring tax hikes, fund sweeps and temporary measures that fail to truly balance the state’s budget.

www.illinoispolicy.org/illinois-passes-55b-budget-with-over-800-million-in-revenue-changes/

- $195 million – $228 million from a new tax amnesty program.

- $171 million from delaying motor fuels tax revenue transfers to the Road Fund.

- $237 million in fund sweeps.

- $72 million in corporate tax hikes.

- $45 million from shorting the state’s Budget Stabilization Fund.

- $36 million from a new sports wagering tax.

- $15 million from removing hotel tax exemptions from short term rental platforms.

- An additional tax on nicotine analogs.

Cell Phone Tax

Watch your wallets folks. Starting July 1, Democrats’ cell phone service tax hike goes into effect. We already pay the highest wireless taxes in the country and now we’re going to have to pay even more thanks to tax and spend Dems.

Other Taxes

The state will impose a tax of $0.25 per sports wager placed beginning on July 1. When 20 million wagers have been placed, that tax will go up to $0.50 per wager,

Short-term rental properties sites like AirBNB and Vrbo will now have to charge their tenants the state’s Hotel Operators’ Occupation Tax, which they had formerly been exempted from paying. That tax comes out to a rate of 6% of 94% of gross receipts for a rental unit, according to the Illinois Department of Revenue.

Tobacco products will also now be taxed at a rate of 45% of their wholesale price, up from 36%.

Governor JB Pritzker and Springfield Democrats floated an idea this past legislative session to add a $1.50 delivery tax to nearly every package shipped to Illinois homes. Luckily, delivery taxes did not receive a vote in the House, but the new tax could still be adopted in veto or special sessions later this year.

House Republicans remain steadfast in their efforts to stop wasteful spending, defend families, oppose new taxes, and introduce pro-growth policies.

National PTSD Awareness Day

June 27 is National PTSD Awareness Day, a time to acknowledge the silent battles many people face long after trauma ends. PTSD can affect anyone, from veterans to survivors of abuse, accidents, or disasters. Today is about breaking the stigma, encouraging open conversations, and making sure support is never out of reach.

Please help me by recommending important businesses in the 114th District to be recognized as a ‘Business of the Month’. It’s my priority to highlight businesses that have a positive impact on communities and lead by example.

Individuals can nominate a 114th District business at any time and can call 618-215-1050 with questions.

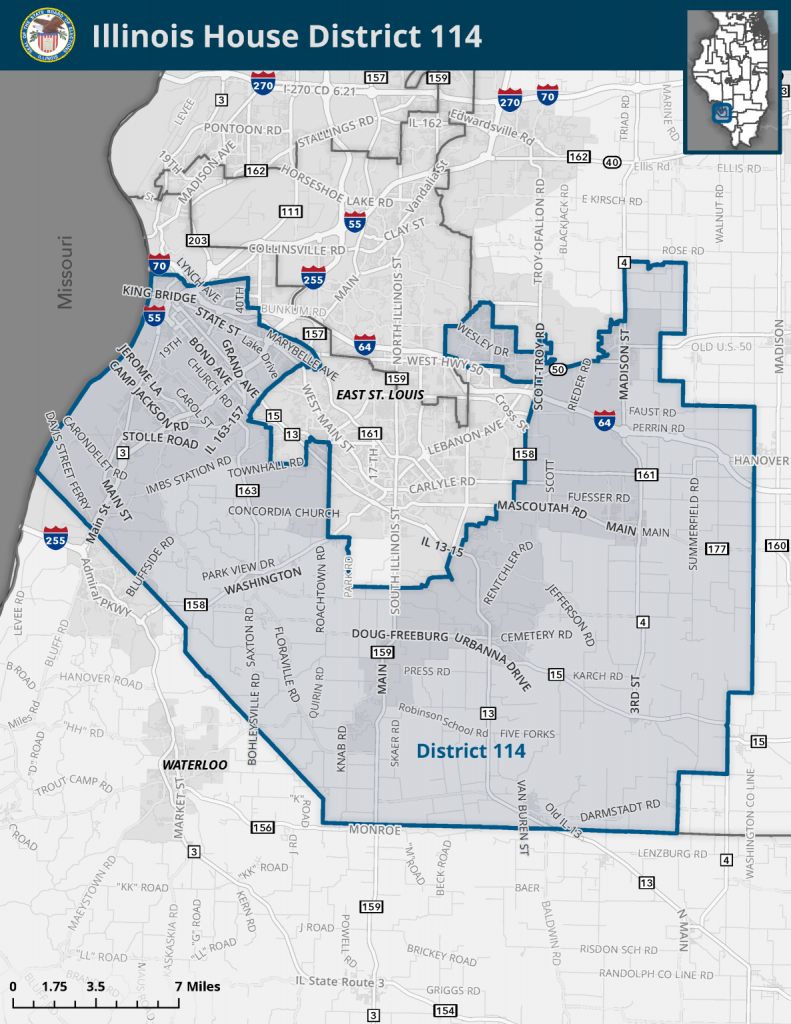

Representative Kevin Schmidt represents the 114th District, which includes a portion of St. Clair County.